UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party Other Than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

A.M. Castle & Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies:

| ||

| (2) | Aggregate number of securities to which transaction applies:

| ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

| ||

| (4) | Proposed maximum aggregate value of transaction:

| ||

| (5) | Total fee paid:

| ||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount previously paid:

| ||

| (2) | Form, Schedule or Registration Statement No.:

| ||

| (3) | Filing Party:

| ||

| (4) | Date Filed:

| ||

A.M. Castle & Co.

| Our Values | ||

1420 Kensington Road, Suite 220

| Integrity & Safety |  | Ownership |  | Service |

| We strive to do the right thing to support our customers, shareholders, suppliers, communities, and one another. We reinforce a culture of safety and well-being to protect our most valuable asset; our people. | Every employee is expected to embody an entrepreneurial spirit. If a process isn’t working, we change it. We understand that each of us has the opportunity to make a meaningful difference in our everyday actions. | Service is in our DNA. We go above and beyond to meet the needs of our stakeholders, without compromising our standards of integrity. We support each other to ensure our customers are satisfied. Customer service is not a department, it’s an attitude. | |||

Oak Brook, Illinois 60523

| Quality |  | Inclusion | ||

| Every action we take is guided by the goal of providing value-added processing, on-time delivery, and outstanding service. If a decision compromises our standard of quality, we reject it We are proud of the role we all play in supporting the value chain at Castle. | We value the unique background and perspective each employee brings to Castle. We are open to healthy debate and discussion while working together toward our common goals. At every level, we are committed to recruiting and investing in top talent from all communities. | ||||

Dear Fellow Stockholders:

| The Elements of Our Culture | ||

| Achieving Business Targets | Driving Innovation and Value | Empowering Our Branches | Investing in Talent and Culture | |||

• Profitability • Operating efficiency • Sales growth • Comprehensive management of assets | • Dynamic customer partnerships • Strategic inventory investments • Cutting-edge equipment • Strong mill relationships | • Investment in people, equipment, and inventory at the branch level • Local leadership • Entrepreneurial spirit | • Commitment to values • Employee engagement • Career development • Constant communication | |||

Table of Contents

| i |

With our financial restructuring behind us, the executive team and I continue to chart a course that will help us achieve business targets, drive innovation, empower our branches, and invest in our talent and Company culture. On behalf of the Boardexecutive team, I want to thank you for your continued support. Your belief in our business allows us to look confidently forward and focus on strategies to build shareholder value over the long-term. I am incredibly proud of Directorswhat we have accomplished together and look forward to reporting on our further success this time next year.

| Sincerely, | |

Marec E. Edgar |  |

| 1 |

Notice of A.M. Castle & Co., a Maryland corporation (“Castle,” the “Company,” “we,” “us” or “our”), weAnnual Meeting

We are pleased to invite you to join usthe Board of Directors (the “Board”) of A. M. Castle & Co. (the “Company”) and senior management at the Company’s 2019 Annual Meeting of Stockholders (“Annual Meeting”).

| Date and Time Wednesday, May 1, 2019 10:00 a.m. C.D.T | Location 1420 Kensington Road Suite 220 Oak Brook, Illinois 60523 |

The items of business for the meeting will be:

| 1. | Election of director nominees; |

| 2. | Approval of the Company’s executive compensation on an advisory (non-binding) basis; |

| 3. | Ratification of the appointment of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

| 4. | Any other business that may properly come before the Annual Meeting. |

The Board established the close of business on February 28, 2019, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. On or about March 19, 2019, a specialfull set of proxy materials, including a copy of the Proxy Statement, the annual report and a proxy card, was first made available to the Company’s stockholders of record. The Board is soliciting the enclosed proxy for use at the Company’s Annual Meeting and any adjournments or postponements thereof.

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the enclosed form of proxy will have discretion to vote on those matters to the same extent as the person signing the proxy would be entitled to vote. It is not currently anticipated that any other matters will be raised at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or by mailing a proxy card in the enclosed envelope, which requires no postage if mailed in the United States. Please review the instructions on each of your voting options described on the enclosed proxy card.

| By Order of the Board | |

| |

| Michelle McIntosh | Oak Brook, Illinois |

| VP, Legal & Secretary | March 19, 2019 |

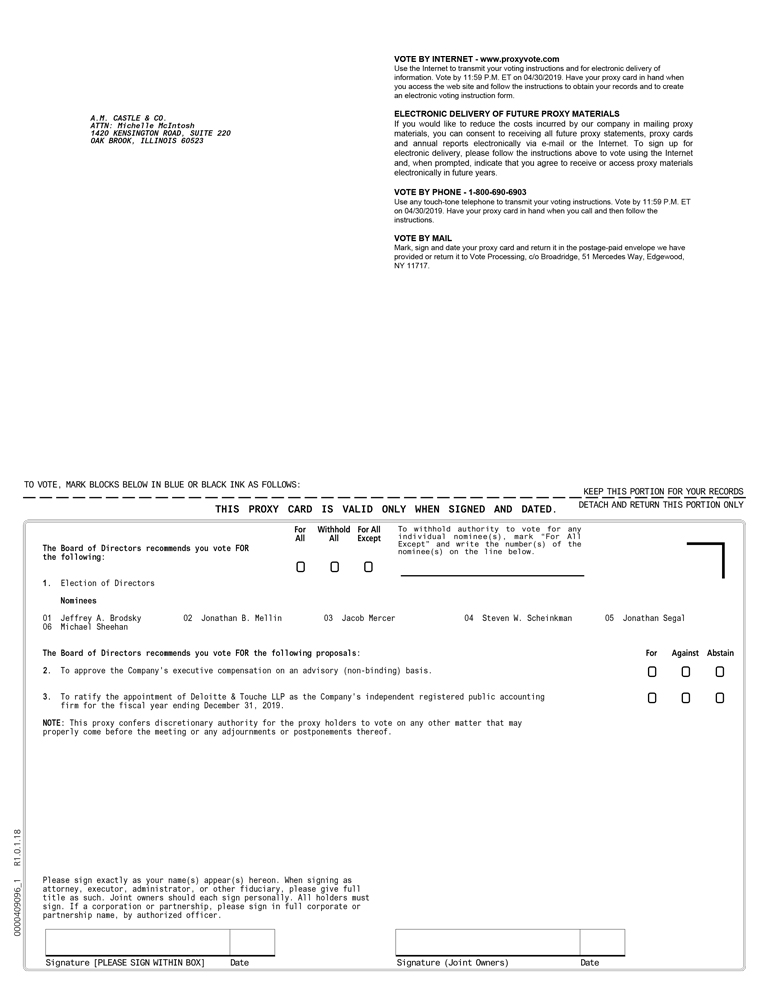

| Voting Information |

| As of the close of business on February 28, 2019, the record date established for determining the stockholders entitled to notice of and to vote at the Annual Meeting, there were 3,634,658 outstanding shares of the Company’s common stock. Each share of common stock outstanding on the record date is entitled to one vote on all matters submitted at the Annual Meeting. |

|

| Vote on the internet |

| Visit www.proxyvote.com by 11:59 P.M. ET on April 30, 2019 for shares held directly and by 11:59 P.M. ET on April 26, 2019 for shares held in a retirement plan. |

|

| Vote by telephone |

| Call (800) 690-6903 and vote 24 hours a day, seven days a week by 11:59 P.M. E.T on April 30, 2019 for shares held directly and by 11:59 P.M. E.T on April 26, 2019 for shares held in a retirement plan. |

|

| Vote by mail |

| Mark, sign, date and return the enclosed proxy card to the address listed on the proxy card by April 17, 2019. |

|

| Vote in person |

| All stockholders of record may vote in person at the Annual Meeting. If you plan to attend the meeting in person, refer to the Other Information section on page 32 for important details on admission requirements. |

| 2 |

| Proposal No. 1: Election of Directors |

Stockholders are being asked to elect six director nominees to serve until the 2020 Annual Meeting of Stockholders. Following the recommendation of the Company’s Governance Committee (the “Governance Committee”), the Company’s Board has nominated each individual presently serving as a director for election at this Annual Meeting.

Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote for the election of directors, although they will be considered present for the purpose of determining the presence of a quorum.

The Company’s Board structure and governance procedures require each director nominee to be approved by the stockholders at each Annual Meeting. Each director elected at the Annual Meeting will hold office until the next succeeding annual meeting of stockholders and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, or removal. Each director nominee listed below has consented to be named in this Proxy Statement and has agreed to serve as a director, if elected, and the Company expects each nominee to be able to serve, if elected.

If any director nominee is unable or unwilling to accept his or her election or is unavailable to serve for any reason, the persons named as proxies will have authority, according to their judgment, to vote or refrain from voting for such alternate director nominee as may be designated by the Board.

The Company’s Corporate Governance Guidelines set forth the process by which its Governance Committee identifies, evaluates, and recommends candidates for nomination to the Board. In making its recommendations of director nominees to the Board, the Governance Committee may also consider any advice and recommendations offered by the Company’s Chief Executive Officer, other directors, the stockholders of the Company, or any advisors the Governance Committee may retain. Any stockholder wishing to suggest a director candidate should submit his or her suggestion in writing to the attention of the Corporate Secretary of the Company, providing the candidate’s name and qualifications for service as a Board member, a document signed by the candidate indicating the candidate’s willingness to serve, if elected, and evidence of the stockholder’s ownership of the Company’s stock. Any stockholder who wishes to formally recommend individuals for nomination to the Board may do so in accordance with the Company’s Bylaws, which will be held on May 6, 2016, at 11:00 a.m., Central Time,require advance notice to the Company and certain other information. If you are interested in recommending a director candidate, you may request a free copy of the Company’s Bylaws by writing to the Secretary of the Company at 1420 Kensington Road, Suite 220, Oak Brook, Illinois 60523 (the “Special Meeting”).60523.

The current membership of the Board represents a diverse mix of directors in terms of background and expertise. In considering whether to recommend persons to be nominated for directors, the Governance Committee will apply the criteria set forth in the Company’s Corporate Governance Guidelines, which include but are not limited to:

| • | Business experience; | |

| • | Integrity; | |

| • | Absence of conflict or potential conflict of interest; | |

| • | Ability to make independent analytical inquiries; | |

| • | Understanding of the Company’s business environment; and | |

| • | Willingness to devote adequate time to Board duties. | |

While the Company’s Corporate Governance Guidelines do not prescribe specific diversity standards, they do provide that the Board will seek a diversified membership for the Board as a whole, in terms of both the personal characteristics of individuals involved and their various experiences and areas of expertise. When identifying and evaluating candidates, the Governance Committee, as a matter of practice, also considers whether there are any evolving needs of the Board that require experience in a particular field and may consider additional factors it deems appropriate. The Governance Committee does not assign specific weights to any particular criterion and no particular criterion is necessarily applicable to all prospective nominees. The Governance Committee also conducts regular reviews of current directors who may be proposed for re-election and their past contributions to the Board.

| 3 |

Under the Company’s Corporate Governance Guidelines, no director may be nominated for re-election following his or her 72nd birthday. On the recommendation of the Governance Committee, the Board may waive this requirement as to any director if it deems a waiver to be in the best interest of the Company.

The Corporate Governance Guidelines are made available on the Company’s website.

In Januaryan uncontested election (i.e., an election where the number of nominees is not greater than the number of directors to be elected), any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withheld Vote”) shall promptly tender his or her resignation following certification of the stockholder vote. The Governance Committee shall promptly consider the resignation offer and make a recommendation to the Board. The Board will act on the Governance Committee’s recommendation within 90 days following certification of the stockholder vote. Thereafter, the Board will promptly publicly disclose its decision regarding whether to accept the director’s resignation offer. Any director who tenders his or her resignation shall not participate in the Governance Committee recommendation or Board action regarding whether to accept the resignation offer. However, if each member of the Governance Committee receives a Majority Withheld Vote at the same election, then all non-employee directors on the Board who did not receive a Majority Withheld Vote shall appoint a committee amongst themselves to consider the resignation offers and recommend to the Board whether to accept them.

Director Nominees Qualifications and Experience

Below is certain biographical and other information regarding the persons nominated for election as directors, which is based upon statements made or confirmed to the Company by or on behalf of these nominees, except to the extent certain information appears in the Company’s records. Ages shown for all nominees are as of the date of the Annual Meeting. Following each nominee’s biographical information, the Company has also provided additional information regarding the particular experience, qualifications, attributes and skills that informed the Governance Committee and the Board’s determination that such nominee should serve as a director.

The Company’s directors have a variety of qualifications, skills and experience that contribute to an effective and well-functioning Board, including the following key characteristics:

| • | Wealth of leadership experience; | |

| • | Demonstrated business acumen and ability to exercise sound business judgment; | |

| • | Extensive board and/or financial experience; and | |

| • | Reputation for integrity, honesty and adherence to the highest ethical standards. |

| 4 |

| Jeffrey A. Brodsky | Age: 60 Director since 2017 Independent Audit (Chair) and Governance Committees |

| Background: |

| Mr. Brodsky is a co-founder and Managing Director of Quest Turnaround Advisors, LLC where he provides advisory and interim management services to boards of directors, senior management and creditors of companies. Currently, Mr. Brodsky leads Quest’s activities as plan administrator for Adelphia Communications Corporation (2007 – Present), a now delisted cable television company, and trust administrator for the Adelphia Recovery Trust (2007 – Present), a Delaware Statutory Trust. He also serves as a director of Her Justice (2010 – Present), a non-profit organization that provides free legal assistance to women living in poverty in New York City. Recently, Mr. Brodsky oversaw Quest’s activities as liquidating trust manager of the ResCap Liquidating Trust (2013 – 2015), a Liquidating Trust formed in connection with Residential Capital, LLC’s Plan of Reorganization under Chapter 11 of the United States Bankruptcy Code, where he led all activities relating to ResCap’s emergence and management of its operations, including the distribution of over $2.2 billion to beneficiaries. Previously, Mr. Brodsky has served in roles as a lead director, a non-executive chairman, or a director of various entities. |

| Current Public Company Directorships: | None |

| Other Public Company Directorships during Past Five Years: | Broadview Networks, Inc. (2012-2017) (publicly registered debt) Horizon Lines, Inc. (2011-2015) (delisted) Euramax Holdings, Inc. (2009-2015) (publicly registered debt) |

| Skills and Qualifications: | |

| Mr. Brodsky’s individual qualifications and skills as a director include his extensive experience in financing, mergers, acquisitions, investments, strategic transactions, and turnaround/performance management. Mr. Brodsky holds a Bachelor of Science degree from New York University College of Business and Public Administration and a Master of Business Administration degree from New York University Graduate School of Business. He is also a Certified Public Accountant. | |

| Jonathan B. Mellin | Age: 55 Director since 2014 Independent Governance (Chair) and Audit Committees |

| Background: |

| Mr. Mellin is President and Chief Executive Officer of Simpson Estates, Inc., a private asset management firm. Mr. Mellin became President of Simpson Estates, Inc. in 2012, prior to being appointed President and Chief Executive Officer in 2013. Mr. Mellin previously served as CFO for the Connors Family group of companies, from 2005 to 2012. |

| Current Public Company Directorships: | Angelo Gordon Energy Fund II (2017 – Present) (registered investment company) |

| Other Public Company Directorships during Past Five Years: | None |

| Skills and Qualifications: | |

| Mr. Mellin’s individual qualifications and skills as a director include his extensive financial background, annual business planning, forecasting, and expense reduction expertise and strong background and experience in strategic transactions. Mr. Mellin is also a Certified Public Accountant and has served as Chief Financial Officer of large private companies and subsidiaries of publicly-held companies. | |

| 5 |

| Jake Mercer | Age: 44 Director since 2017 Independent Governance and Human Resources Committees |

| Background: | |

| Mr. Mercer is Partner and Head of Special Situations and Restructuring for Whitebox Advisors LLC (2007 – Present), an employee-owned hedge fund sponsor. He also serves as a director of Nalpropion Pharmaceuticals (2018 – Present), a private American pharmaceutical company, Malamute Energy, Inc. (2016 – Present), a controlling interest in the Umiat Project, director and Manager of Jerritt Canyon LLC (2015 – Present), a private mid-tier gold producer; and was a director for Piceance Energy, LLC (2012 – 2015), a subsidiary of Laramie Energy II, LLC, a Denver-based company focused on developing unconventional oil and gas reserves within the U.S. Rocky Mountains Piceance Basin. Mr. Mercer previously worked for Xcel Energy (2005 – 2007), a western and mid-western state energy provider, as Assistant Treasurer. | |

| Current Public Company Directorships: | Hycroft Mining Corporation (2015 - Present) (OTCMKTS: HYCT) SAExploration Holdings Inc. (2016-present) (NASDAQ: SAEX) Adanac Molybdenum Corporation (2015-present) (formerly TSX Venture: AUA) White Forest Resources, formerly Xinergy Ltd. (2016-present) (formerly TSX: XRG) |

| Other Public Company Directorships during Past Five Years: | Platinum Energy Solutions (2013-2017) (formerly NYSE: FRAC) Par Pacific Holdings, Inc., formerly Par Petroleum Corporation (2012-2015) (NYSE American: PARR) |

| Skills and Qualifications: | |

| Mr. Mercer’s individual qualifications and skills as a director include his extensive investment and financial expertise, particularly in public and private debt restructuring, as well as significant turnaround and performance improvement experience. He has served on a number of public and private company boards and holds a Bachelor of Arts degree in Finance and Economics from St. John’s University. Mr. Mercer is also a Chartered Financial Analyst. | |

| Steven W. Scheinkman | Age: 65 Director since 2015 Chairperson |

| Background: |

| Mr. Scheinkman is the Chief Executive Officer (2018 – Present) of the Company and Chairperson of the Board (since August 2017). Mr. Scheinkman was previously the President and Chief Executive Officer (2015 – 2018) of the Company. In addition, Mr. Scheinkman previously served as President, Chief Executive Officer and director of Innovative Building Systems LLC (2010 – 2015), a leading custom modular home producer; as President, Chief Executive Officer, and director of Transtar Metals Corp. (1999 - 2006), a supply chain manager/distributor of high alloy metal products for the transportation, aerospace and defense industries; and following Transtar’s acquisition by the Company in September 2006, as President of Transtar Metals Holdings Inc. until September 2007 and thereafter served as its advisor until December 2007. Furthermore, he previously served as a director of Claymont Steel Holdings, Inc. (2006 – 2008), a private manufacturer of custom discrete steel plate. |

| Current Public Company Directorships: | None |

| Other Public Company Directorships during Past Five Years: | None |

| Skills and Qualifications: | |

| Mr. Scheinkman’s individual qualifications and skills as a director include his extensive experience serving as an executive of various metal products companies, his significant financial expertise, and his significant experience in strategic transactions. He also successfully led the Company’s recent turnaround and financial restructuring. | |

| 6 |

| Jonathan Segal | Age: 37 Director since 2017 Lead Independent Director Audit and Human Resources (Chair) Committees |

| Background: | |

| Mr. Segal is managing director and portfolio manager of Highbridge Capital Management, LLC (2007 – Present), a leading global alternative investment firm. Before joining Highbridge, Mr. Segal previously worked as a Research Analyst at Sanford C. Bernstein & Co., LLC (2005 – 2007), an indirect wholly-owned subsidiary of AllianceBernstein L.P. | |

| Current Public Company Directorships: | Hycroft Mining Corporation (2015 - Present) (OTCMKTS: HYCT) |

| Other Public Company Directorships during Past Five Years: | Contura Energy (2016-2018) (OTCMKTS: CNTE) |

| Skills and Qualifications: | |

| Mr. Segal’s individual qualifications and skills as a director include his extensive capital markets, investment, and financial expertise; his significant experience in public and private debt restructuring; and his turnaround and performance improvement experience. He has served on a number of public and private company boards and received a Bachelor of Arts degree in Urban Studies from the University of Pennsylvania. | |

| Michael J. Sheehan | Age: 58 Director since 2017 Human Resources Committee |

| Background: | ||

| Mr. Sheehan is the Managing Member of Whitecap Performance LLC (2013 – Present), a marketing consultancy, Whitecap Aviation (2013 – Present), an aircraft charter operation, and Managing Partner of Allied Sports a division of Allied Global Marketing (2018 – Present). Mr. Sheehan is a Partner of Vermont Donut Enterprises (2013 – Present), a privately-held holding company with related interests in various food purveying businesses. He also serves on the Board of South Shore Bank (2012 – Present), a full service mutual savings bank in Massachusetts. Mr. Sheehan is the former Chief Executive Officer of Boston Globe Media Partners (2014 – 2017), a leading media company. He previously served as Chairman, Chief Executive Officer, President, and Chief Creative Officer of Hill Holliday (2000 – 2014), a full-service marketing and communications agency; and as Executive Vice President and Executive Creative Director for DDB Chicago (1999 – 2000), a full-service advertising agency. He also serves on the Boards of Harvard University’s American Repertory Theater (2011 – Present), a professional not-for-profit theater; Catholic Charities of the Archdiocese of Boston (2006 – Present), part of the Catholic Charities network; and Newport Festivals (2017 – Present), a music festival foundation. | ||

| Current Public Company Directorships: | None |

| Other Public Company Directorships during Past Five Years: | None |

| Skills and Qualifications: | |

| Mr. Sheehan’s individual qualifications and skills as a director include his extensive experience in managing large public and private companies and in sales and marketing leadership. He attended the United States Naval Academy and graduated from Saint Anselm College in 1982 with a Bachelor of Arts degree in English. Mr. Sheehan previously served as a director of the Company from July 27, 2016, to August 31, 2017. | |

| ü Our Board recommends that you vote FOR the proposed director nominees. |

| 7 |

| Corporate Governance |

The Company has no policy that requires the combination or separation of the roles of Chairperson or Chief Executive Officer. Mr. Scheinkman, the Company’s Chief Executive Officer, has served as Chairperson of the Board since August 2017, and Mr. Segal, a non-employee independent director, has served as Lead Independent Director since November 2017. In his role as Lead Independent Director, Mr. Segal presides over executive sessions of the independent directors and meetings of the full Board in the absence of the Chairperson.

The Company has historically separated the positions of Chief Executive Officer and Chairperson of the Board, allowing its Chief Executive Officer to focus on business strategic growth initiatives, while allowing the Chairperson to lead the Board in its fundamental role of providing advice to, and independent oversight of, management.

Due to Mr. Scheinkman’s familiarity with the Company’s business and his knowledge of the Company’s industry, the Board believes that continuing to combine the roles of Chief Executive Officer and Chairperson of the Board uniquely positions Mr. Scheinkman to identify strategic priorities and to lead the Board in discussions regarding strategy, business planning, and operations. This structure also allows for efficient decision-making and provides a unified strategic vision and clear leadership for the Company.

The Chairperson of the Board:

| • | Provides strategic leadership and guidance; | |

| • | Establishes the agendas for Board meetings, with advice from executive and senior management teams; | |

| • | Advises and consults with the executive and senior management teams regarding strategies, risks, opportunities, and other matters; and | |

| • | Presides over meetings of the full Board. | |

While the Board believes the Company’s leadership model provides appropriate oversight and an effective governance structure, it recognizes that, depending on the circumstances, other leadership models, such as separating the roles of Chief Executive Officer and Chairperson of the Board, might be appropriate. Accordingly, the Board periodically reviews its leadership structure.

The Board has three standing committees: the Audit Committee, the Governance Committee and the Human Resources Committee. Each committee has a written charter adopted by the Board, copies of which are posted under the “Corporate Governance” section of the Company’s website at https://castlemetals.com/investors/corporate-governance.

Each Committee reviews the appropriateness of its charter and performs a self-evaluation at least annually. The Board will review the composition of each committee in light of any expected changes to the Board’s composition as a result of the annual meeting of stockholders each year.

| 8 |

The following summarizes the current membership and responsibilities of each of the Company’s three standing Board committees:

| Audit Committee | The Company’s Audit Committee reviews the Company’s audited financial statements with management; reviews the qualifications, performance and independence of the Company’s independent registered public accountants; approves audit fees and fees for the preparation of the Company’s tax returns; reviews the Company’s accounting policies and internal control procedures; and considers and appoints the Company’s independent registered public accountants. The Audit Committee has the authority to engage the services of independent outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities. |

| The Audit Committee oversees the annual risk management assessments, monitors reports received on the Company’s incident reporting hotline, oversees the Company’s compliance program, including an annual review of the Company’s Code of Conduct, and prepares the “Report of the Audit Committee” for its stockholders on page 30. | |

| Governance Committee | The Company’s Governance Committee oversees all corporate governance matters, including acting as an independent committee evaluating transactions between the Company and directors and officers of the Company; reviewing governance policies and practices; reviewing governance-related legal and regulatory matters that could impact the Company; reviewing and making recommendations on the overall size and composition of the Board and its committees; overseeing Board recruitment, including identification of potential director candidates, evaluating candidates, and recommending nominees for membership to the full Board; and leading the annual self-evaluation of the Board and its committees. The Governance Committee has the authority to engage the services of outside consultants and advisors as it deems necessary or appropriate to carry out its duties and responsibilities. |

| Human Resources Committee | The Company’s Human Resources Committee assists the Board in the discharge of its responsibilities with respect to employee compensation including the adoption, periodic review and oversight of the Company’s compensation strategy, policies and plans. The Human Resources Committee approves and administers the incentive compensation and equity-based plans of the Company. The Human Resources Committee has the authority to engage the services of independent outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities. |

Director Independence; Financial Expert

While the Company’s stock is currently traded on, the OTCQX market, which requires the Company to establish and maintain fundamental corporate governance standards, the Company has elected to adopt more exacting governance standards that are substantially similar to the NASDAQ listing standards. The Board has affirmatively determined that each current Board member, except for Mr. Scheinkman, is “independent” within the definitions contained in the current NASDAQ listing standards and the standards set by the Board in the Company’s Corporate Governance Guidelines. Furthermore, the Board has determined that all members of the Company’s Audit Committee meet the financial sophistication requirements of the NASDAQ listing standards. The Board has determined that Mr. Brodsky qualifies as an “audit committee financial expert” for purposes of the SEC rules.

| 9 |

During 2018, the Board held eight meetings. The Board’s non-employee directors met in regularly scheduled executive sessions to evaluate the performance of the Chief Executive Officer and to discuss other corporate matters. Mr. Steven Scheinkman, presided as the Chairperson of the Board at all of the eight meetings of the Board. Additionally, during 2018, there were four meetings of the Audit Committee, five meetings of the Governance Committee, and five meetings of the Human Resources Committee. Each of the directors attended 75% or more of all the meetings of the Board and the Committees on which he served.

We strongly encourage, but do not require, directors to attend our annual meetings of stockholders. All directors who were nominated for reelection at our 2018 Annual Meeting of Stockholders attended that meeting.

Non-Employee Director Compensation

Cash Compensation

The Company’s director compensation program provides that the cash compensation paid to, or earned by, its non-employee directors will be comprised of the following components:

| Role | Annual Retainers* | |

| Director | $60,000 | |

| Non-Employee Board Chairperson | $40,000 | |

| Audit Committee Chairperson | $10,000 | |

| Governance Committee Chairperson | $5,000 | |

| Human Resources Committee Chairperson | $7,500 | |

| *Retainers are paid in quarterly installments. | ||

Equity-Based Compensation

The equity-based compensation paid to the Company’s non-employee directors in 2018 consisted of restricted stock granted pursuant to the Company’s 2017 Management Incentive Plan. Messrs. Mercer and Segal waived their equity-based compensation for 2018.

In 2018, each director, with the exception of Messrs. Mercer and Segal, received a restricted stock award in an amount valued at $90,000, based upon the 60-day trailing average stock price on the date of grant.

Other Compensation

Reimbursement is made for travel and accommodation expenses incurred to attend meetings and participate in other corporate functions and for the cost of attending one director continuing education program annually. For each director, the Company pays and maintains coverage for personal excess liability, business travel and accident, and director and officer liability insurance policies.

| 10 |

Director Compensation Table – Fiscal Year 2018

The following table summarizes the compensation paid to or earned by the non-employee directors for 2018. Any employee of the Company who serves as a director receive no additional compensation for service as a director.

Name Fees

Earned

or

Paid in

Cash

($) Stock

Awards

($)(1) Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($) All

Other

Compensation

($) Total

($)Jeffrey A. Brodsky(2) 70,000 99,658 — — 169,658 Jonathan Mellin 65,000 99,658 — — 164,658 Jacob Mercer(3) 60,000 — — — 60,000 Jonathan Segal(4) 67,500 — — — 67,500 Michael Sheehan 60,000 99,658 — — 159,658

| (1) | Stock Awards. On April 25, 2018, Messrs. Brodsky, Mellin and Sheehan received an annual restricted stock award of 22,910 shares of the Company’s common stock. The amounts shown reflect the grant date fair value computed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 (ASC Topic 718). |

| (2) | Mr. Brodsky elected to have his cash compensation paid to Jeffrey Brodsky & Associates, of which he is Managing Director. |

| (3) | Mr. Jacob Mercer elected to have his cash compensation paid to various funds related to Whitebox Advisors LLC. |

| (4) | Mr. Segal elected to have his cash compensation paid to Highbridge Capital Management, LLC. |

The Board is actively involved in oversight of risks that could affect the Company. The Board implements its risk oversight function as a whole and through delegation to committees, which meet regularly and report back to the full Board. The risk management role of each of the committees is detailed further below:

| Board of Directors | |||||||

| Audit Committee | Governance Committee | Human Resources Committee | |||||

| Oversees risk related to the Company’s financial statements, financial reporting process and accounting and legal matters; internal audit function; the Company’s compliance program and the Company’s cyber security action plan.; Also reviews outcome of the Company’s periodic Enterprise Risk Assessment, which identifies and evaluates potential material risks that could affect the Company and identifies appropriate mitigation measures | Oversees governance-related risk, including development of the Company’s policies and practices, and Board succession planning | Oversees risks associated with the Company’s compensation programs; reviews and approves compensation features that mitigate risk and align pay to performance with the interests of its executives and its stockholders; and oversees the Company’s succession-planning process for key executive and managerial roles | |||||

The full Board retains responsibility for general oversight of risks. Key risks to the Company’s business strategy are considered by the Board as part of the Company’s annual strategy review. Additional information regarding the risks faced by the Company is included in its Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 15, 2019.

The Board has adopted a Code of Conduct for Directors and a Code of Conduct for Officers. A copy of each Code of Conduct policy can be found on the “Corporate Governance” section of the Company’s website at https://castlemetals.com/investors/corporate-governance.

| 11 |

Every director and officer is required to read and follow the Code that is applicable to his or her role. Any waiver of either Code of Conduct requires the approval of the Governance Committee, and must be promptly disclosed to the Company’s stockholders and the public. The Company intends to disclose on the “Corporate Governance” section of its website any material amendments to, or waivers from, the Code of Conduct.

The Company’s Related-Party Transactions Policy governs the review, approval and ratification of transactions involving the Company and related persons where the amount involved exceeds $120,000. Related persons include:

| • | Directors; | |

| • | Director nominees; | |

| • | Executive officers; | |

| • | 5% stockholders; | |

| • | Immediate family members of the above persons; and | |

| • | Entities in which the above persons have a direct or indirect material interest. | |

Potential related-party transactions are reviewed by the highest ranking member of the Company’s Legal Department. If the highest ranking member of the Company’s Legal Department determines that the proposed transaction is a related-party transaction for such purposes, the proposed transaction is then submitted to the Governance Committee for review.

The Governance Committee considers all of the relevant facts and circumstances available, including but not limited to:

| • | whether the proposed transaction is on terms that are fair to the Company and no less favorable to the Company than terms that could have been reached with an unrelated third party; | |

| • | the purpose of, and the potential benefits to, the Company of entering into the proposed transaction; | |

| • | the impact on a director’s independence, in the event such person is an outside director; and | |

| • | whether the proposed transaction would present an improper conflict of interest. | |

In the event that the Company becomes aware of a related-party transaction that has not been previously approved or ratified by the Governance Committee, a similar process will be undertaken by the Governance Committee in order to determine if the existing transaction should continue or be terminated.

A copy of the Company’s Related-Party Transactions Policy can be found on the “Corporate Governance” section of its website at https://castlemetals.com/investors/corporate-governance.

Related-Party Transactions and Relationships

Emergence from Bankruptcy

As previously disclosed, on June 18, 2017 (the “Petition Date”), the Company and four of its subsidiaries (together with the Company, the “Debtors”) filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) with the United States Bankruptcy Court for the District of Delaware in Wilmington, Delaware (the “Bankruptcy Court”). Also on June 18, 2017, the Debtors filed their Prepackaged Joint Chapter 11 Plan of Reorganization with the Bankruptcy Court and on July 25, 2017, the Debtors filed their Amended Prepackaged Joint Chapter 11 Plan of Reorganization (the “Plan”) with the Bankruptcy Court. On August 2, 2017, the Bankruptcy Court entered an order confirming the Plan. On August 31, 2017 (the “Effective Date”), the Plan became effective pursuant to its terms and the Debtors emerged from their Chapter 11 cases. On February 6, 2018, the Bankruptcy Court entered a final order closing the Chapter 11 cases of the Debtors.

Pursuant to the Plan, on the Effective Date, the Company entered into separate Transaction Support Agreements (as amended, modifiedan Indenture with Wilmington Savings Fund Society, FSB, as trustee and collateral agent and, pursuant thereto, issued approximately $164.9 million in aggregate original principal amount of its 5.00% / 7.00% Convertible Senior Secured PIK Toggle Notes due 2022 (the “Second Lien Notes”).

The Second Lien Notes are five year senior obligations of the Company and certain of its subsidiaries, secured by a lien on all or supplementedsubstantially all of the assets of the Company, its domestic subsidiaries, and certain of its foreign subsidiaries. The Second Lien Notes are convertible into shares of the Company’s common stock at any time at the initial conversion price of $3.77 per share, which rate is subject to adjustment as set forth in the Second Lien Notes Indenture. Interest on the Second Lien Notes accrues at the rate of 5.00%, except that the Company may, in certain circumstances, pay at the rate of 7.00% in kind.

All outstanding indebtedness of the Debtors under the Company’s 12.75% Senior Secured Notes due 2018 and the Indenture dated February 8, 2016, by and between the Company, as issuer, its guarantors, and U.S. Bank National Association, as trustee, and all outstanding indebtedness of the Debtors under the Company’s 5.25% Convertible Senior Secured Notes due 2019 and the Indenture dated May 19, 2016, by and between the Company, as issuer, its guarantors, and U.S. Bank National Association, as trustee, was discharged and canceled in exchange for Second Lien Notes and new common stock in the Company.

Stockholders Agreement

Pursuant to the date hereof,Plan, on August 31, 2017, the “Support Agreements”Company entered into a Stockholders Agreement (the “Stockholders Agreement”) with holdersHighbridge Capital Management, LLC (“Highbridge”), Whitebox Advisors LLC (“Whitebox”), SGF, Inc. (“SGF”), Corre Partners Management, LLC (“Corre”), Wolverine Flagship Fund Trading Limited (“WFF”), and certain members of the Company’s management. The Stockholders Agreement includes certain customary board designation rights, preemptive rights, transfer restrictions, and tag-along and drag-along rights. For additional information on the terms of the Stockholders Agreement, see the Company’s Registration Statement on Form 8-A filed with the SEC on August 31, 2017.

Registration Rights Agreement

Pursuant to the Plan, on the Effective Date, the Company entered into a Registration Rights Agreement (the “Supporting Holders”“Registration Rights Agreement”) of 89.7%with Highbridge, Whitebox, SGF, Corre and WFF. Under the Registration Rights Agreement, the Company has granted registration rights to those recipients who are party to the Registration Rights Agreement with respect to certain securities of the Company. For additional information on the terms of the Registration Rights Agreement, see the Company’s Registration Statement on Form 8-A filed with the SEC on August 31, 2017.

Highbridge Capital Management, LLC

One of the Company’s current directors, Jonathan Segal, serves as a managing director of, and portfolio manager for, Highbridge. Pursuant to the Plan and the Stockholders Agreement, Highbridge and/or the its affiliates have the right to designate one member of the Board. Mr. Segal was selected by Highbridge. Furthermore, on the Effective Date, in connection with the transactions described above, Highbridge and/or one or more of its affiliates received approximately $49.7 million in aggregate principal amount of the Company’s 7.00% Convertible SeniorSecond Lien Notes, due 2017 (the “Existing Convertible Notes”) providing for the terms of exchanges (the “Exchanges”)509,105 shares of the Existing ConvertibleCompany’s new common stock and a cash payment of $4.0 million.

Highbridge has received interest payments, in the amounts of $3,773,825 (in 2018) and 1,163,787, (in 2017) with respect to its Second Lien Notes, for new 5.25% Senior Secured Convertible Notes due 2019 (the “New Convertible Notes”).in each case commensurate with other holders thereof.

Whitebox Advisors LLC

One of the Company’s directors, Jacob Mercer, is the Head of Restructuring and Special Situations at Whitebox. Pursuant to the Support Agreements,Plan and the Supporting Holders agreedStockholders Agreement, Whitebox and/or its affiliates and/or the its affiliates have the right to participatedesignate one member of the New Board. Mr. Mercer was selected by Whitebox. Furthermore, on the Effective Date, in connection with the transactions described above, Whitebox and/or one or more of its affiliates received approximately $46.0 million in aggregate principal amount of Second Lien Notes, 400,876 shares of the Company’s new common stock and a cash payment of $3.6 million.

Whitebox has received interest payments, in the Exchangesamounts of $3,507,348 (in 2018) and vote any$1,078,876, in 2017 with respect to its Second Lien Notes, in each case commensurate with other holders thereof.

Simpson Estates, Inc.

One of the Company’s current directors, Mr. Mellin, serves as the President, Chief Executive Officer and Chief Investment Officer of Simpson Estates. Pursuant to the Plan and the Stockholders Agreement, Simpson Estates and/or its affiliates have the right to designate one member of the Board. Simpson Estates selected Mr. Mellin. Furthermore, on the Effective Date, in connection with the transactions described above, Simpson Estates and/or one or more of its affiliates received approximately $24.9 million in aggregate principal amount of the Second Lien Notes, 206,557 shares of the Company’s new common stock and a cash payment of $2.0 million.

| 13 |

Simpson received interest payments, in the amounts of $524,018 (in 2018) and $166,985 (in 2017) with respect to its Second Lien Notes, in each case commensurate with other holders thereof.

Corre Partners Management, LLC

On the Effective Date and in connection with the transactions described above Corre, and/or one or more of its affiliates received approximately $24.2 million in aggregate principal amount of the Company they may hold in favorSecond Lien Notes, 234,554 shares of the proposalsCompany’s new common stock and a cash payment of $3.1 million.

Corre received interest payments, in the amounts of $1,772,614 (in 2018) and $565,620 (in 2017) with respect to its Second Lien Notes, in each case commensurate with other holders thereof.

Wolverine Flagship Fund Trading Limited

On the Effective Date and in connection with the transactions described herein.above, WFF and/or one or more of its affiliates received approximately $8.5 million in aggregate principal amount of the Second Lien Notes, 70,905 shares of the Company’s new common stock and a cash payment of $.7 million.

Additionally,

WFF received interest payments, in the amounts of $623,429 (in 2018) and $198,664 (in 2017) with respect to its Second Lien Notes, in each case commensurate with other holders thereof.

Pursuant to the Plan and Stockholders Agreement, Corre and WFF have the right by mutual agreement to designate one member of the Board; provided that such designated individual who qualifies as an “independent director” under NASDAQ Marketplace Rule 5605(a)(2). Mr. Brodsky was selected by Corre and WFF.

Revolving Credit and Security Agreement

As previously disclosed, on June 1, 2018, the Company entered into agreements with affiliatesan Amendment No. 1 to Revolving Credit and Security Agreement (the “Credit Agreement Amendment”) by and among the Company, the other borrowers and guarantors party thereto and PNC Bank, National Association as the agent and the lenders, which amends that certain Revolving Credit and Security Agreement dated as of W.B. & Co.August 31, 2017 (as amended by the Credit Agreement Amendment, the “Expanded Credit Facility”) to provide for additional borrowing capacity. The Expanded Credit Facility provides for an additional $25 million last out Revolving B credit facility made available in part by way of a participation in the Revolving B credit facility by each of Highbridge in the aggregate amount of approximately $7.6 million, Whitebox in the aggregate amount of approximately $7.1 million, SGF in the aggregate amount of $3.8 million, and FOM Corporation (collectively,Corre in the “Significant Equity Holders”), pursuantaggregate amount of approximately $3.0 million. The Revolving B credit facility will bear interest at 12.0% per annum and which will be paid-in-kind unless the Company elects to whichpay such interest in cash and the Significant Equity Holders have agreedRevolving B payment conditions specified in the Expanded Credit Facility are satisfied. Borrowings under both the existing Revolving B credit facility will mature on February 28, 2022. The Expanded Credit Facility continues to votebe secured by substantially all personal property assets of theirthe Company and its domestic subsidiary guarantors.

| 14 |

Directors, Director Nominees and Management

The following table sets forth the number of shares and percentage of the Company’s common stock in favorthat was owned beneficially as of March 1, 2019, by each of the proposals contained herein. Collectively,Company’s directors and director nominees, each current member of Executive Management, including those set forth in the Significant Equity HoldersSummary Compensation Table in Proposal 2 hereof, and by all directors, director nominees and executive management as a group, with each person having sole voting and dispositive power except as indicated:

| Beneficial Owner | Shares of Common Stock Beneficially Owned(1) | Percentage of Common Stock(2) | Additional Information | ||

| Directors and Director Nominees | |||||

| Jeffrey A. Brodsky | 22,910 | * | |||

| Jonathan Mellin | 24,806 | * | (3) | ||

| Jacob Mercer | 0 | * | |||

| Jonathan Segal | 0 | * | |||

| Michael Sheehan | 24,576 | * | |||

| Management | |||||

| Steven Scheinkman, Chief Executive Officer | 607,127 | 16.7% | (4) | ||

| Patrick Anderson, Executive Vice President, Finance & Administration | 321,090 | 8.8% | (5) | ||

| Marec Edgar, President | 321,016 | 8.8% | (5) | ||

| All directors, director nominees and executive officers as a group (8 persons) | 1,321,525 | 36.4% | (6) |

* Percentage of shares owned equals less than 1%.

| (1) | Excludes a total of 506,413 shares of common stock owned by executive management, which may be acquired upon conversion of the Company’s Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and each beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond such beneficial owner’s control. |

| (2) | Based on 3,634,658 shares of common stock issued and outstanding as of March 1, 2019. |

| (3) | Represents 24,806 shares held by Mr. Mellin individually. Excludes 325,521 shares Mr. Mellin may be deemed to beneficially own in his capacity as trustee, officer or general partner of certain trusts and other entities established for the benefit of members of the Simpson family. See Note (5) under the “Principal Stockholders” table below. Also excludes 6,608,760 shares of common stock, which may be acquired upon conversion of the Company’s Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and the beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond his control. |

| (4) | Excludes 246,173 shares of common stock which may be acquired upon conversion of the Company’s Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and the beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond his control. |

| (5) | Excludes 130,120 shares of common stock which may be acquired upon conversion of the Company’s Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and the beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond his control. |

| (6) | Excludes 506,413 shares of common stock which may be acquired upon conversion of the Company’s Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and each beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond such beneficial owner’s control. Ronald Knopp, previously the Company’s Executive Vice President, Operations & IT, passed away on February 3, 2019, and is not included in this table. |

| 15 |

The only persons who held of record or, to the Supporting Holders hold approximately 48%Company’s knowledge (based on the review of Schedules 13D, 13F and 13G, and amendments thereto), owned beneficially more than 5% of the outstanding shares of the Company’s common stock as of the Record Date (as defined below).March 1, 2019, are set forth below, with each person having sole voting and dispositive power except as indicated:

Pursuant to the Support Agreements, for each $1,000 principal amount of Existing Convertible Notes validly exchanged in the Exchanges, an exchanging holder of Existing Convertible Notes will receive $700 principal amount of New Convertible Notes, plus accrued and unpaid interest. The New Convertible Notes are convertible, under certain circumstances, into cash, shares of our common stock, or a combination of cash and shares of our common stock, at our election, at an initial conversion rate of 444.444 shares of common stock per $1,000 principal amount (equivalent to an initial conversion price of $2.25 per share of common stock), subject to adjustments, which, after completion

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Percentage of Common Stock (1) | ||

| Highbridge Capital Management, LLC/1992 MSF International Ltd. 40 West 57th Street, 32nd Floor New York, New York 10019 | 509,105 | (2)(6) | 14% | |

| Whitebox Advisors LLC/Whitebox General Partner LLC 3033 Excelsior Boulevard, Suite 300 Minneapolis, Minnesota 55416 | 400,870 | (3)(6) | 11% | |

| Corre Partners Advisors, LLC/Corre Partners Management, LLC/ John Barrett/Eric Soderlund 1370 Avenue of the Americas, 29th Floor New York, New York 10019 | 233,472 | (4)(6) | 6.4% | |

| W.B. & Co FOM Corporation SGF, LLC The Northern Trust Company Jonathan B. Mellin Reuben S. Donnelley 30 North LaSalle Street, Suite 1232 Chicago, Illinois 60602-2504 | 370,993 | (5)(6) | 10.2% |

| (1) | Based on 3,634,658 shares of common stock issued and outstanding as of March 1, 2019. |

| (2) | Highbridge Capital Management, LLC (“HCM”), the trading manager of 1992 MSF International Ltd. and 1992 Tactical Credit Master Fund, L.P. (together, the “1992 Funds”), may be deemed to be the beneficial owner of the shares held by the 1992 Funds. The 1992 Funds disclaim any beneficial ownership of these shares except to the extent of their pecuniary interest therein. The business address of HCM is 40 West 57th Street, 32nd Floor, New York, New York 10019 and the business address of the 1992 Funds is c/o HedgeServ (Cayman) Ltd., Willow House, Cricket Square Floor 3, George Town, Grand Cayman KY1-1104, Cayman Islands. |

| (3) | Whitebox Advisors LLC and/or Whitebox General Partner LLC may be deemed to be the beneficial owner of 400,870 shares of common stock, constituting 11% of the Company’s outstanding shares of common stock. These shares are directly owned by Pandora Select Partners, L.P., Whitebox Asymmetric Partners, L.P., Whitebox Credit Partners, L.P., Whitebox GT Fund, LP, Whitebox Institutional Partners, L.P., Whitebox Multi-Strategy Partners, L.P. and Whitebox Term Credit Fund I, L.P. (together, the “Private Funds”) and may be deemed to be beneficially owned by (a) Whitebox Advisors LLC by virtue of its role as the investment manager of the Private Funds and/or (b) Whitebox General Partner LLC by virtue of its role as the general partner of the Private Funds. The address of Whitebox Advisors LLC and Whitebox General Partner LLC is 3033 Excelsior Blvd, Suite 300, Minneapolis, MN 55416. Each of the private funds disclaims beneficial ownership of these shares except to the extent of their pecuniary interest therein. |

| (4) | Corre Partners Advisors, LLC (the “General Partner”) serves as the general partner of Corre Opportunities Fund, LP, Corre Opportunities Qualified Master Fund, LP and Corre Opportunities II Master Fund, LP (together, the “Corre Funds”), which directly own the shares of common stock. The General Partner has delegated investment authority over the assets of the Funds to Corre Partners Management, LLC (the “Investment Advisor”). Each of Mr. John Barrett and Mr. Eric Soderlund serve as a managing member of the General Partner. The address for each of the General Partner, the Investment Advisor, Mr. Barrett, Mr. Soderlund and the Corre Funds is 12 East 49th Street, Suite 4003, New York, NY 10017. As a result of the relationships described in this footnote (4), each of the General Partner, the Investment Advisor, Mr. Barrett and Mr. Soderlund may be deemed to be the beneficial owner of 233,472 shares of common stock, constituting 6.4% of the Company’s outstanding shares of common stock. Each of the foregoing persons disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. |

| (5) | Includes: (i) shares held by W.B & Co. on behalf of certain members of an extended family group and various trusts, estates and estate planning vehicles established by certain deceased and surviving family members (together, the “Simpson Estate Members”); (ii) shares held by SGF; (iii) shares held by Mr. Donnelley individually, shares held by a member of his household, and shares beneficially owned by Mr. Donnelley in his capacity as general partner of a Simpson Estate member; (iv) shares held by |

| 16 |

| Mr. Mellin individually and shares beneficially owned by Mr. Mellin in his capacity as trustee, officer or general partner of certain Simpson Estate Members; (v) shares held by FOM Corporation (“FOM”) on behalf of certain Simpson Estate Members and shares beneficially owned by FOM Corporation in its capacity as trustee , trust administrator or custodian of certain Simpson Estate Members; and (vi) shares held by The Northern Trust Company in its capacity as trustee of certain Simpson Estate Members. SGF, FOM, W.B. & Co., Mr. Mellin, Mr. Donnelley and The Northern Trust Company may be deemed to constitute a group pursuant to Rule 13d-5(b) of the Securities Exchange Act of 1934, as amended. Each beneficial owner disclaims beneficial ownership of any shares held by any other beneficial owner, except to the extent of any pecuniary interest it may have. | |

| (6) | Excludes shares of common stock which may be acquired upon conversion of the Second Lien Notes, because the mode of payment is determined in the sole discretion of the Company and the beneficial owner’s right to obtain shares is therefore subject to a material contingency beyond its control. The beneficial owner disclaims beneficial ownership of any shares of common stock that they might receive upon conversion of the Second Lien Notes. Because of the relationship between the beneficial owner and the other stockholders of the Company party to the Stockholders Agreement, the beneficial owner may be deemed, pursuant to Rule 13d-3 under the Securities Act, to beneficially own a total of 2,988,799 shares of common stock, which represents the aggregate number of shares of common stock beneficially owned by the parties to the Stockholders Agreement. The beneficial owner disclaims beneficial ownership of any shares of common stock held by any other party to the Stockholders Agreement, except to the extent of any pecuniary interest it may have. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchanges, could result inSecurities Exchange Act of 1934, as amended, requires the issuanceCompany’s executive officers and directors and beneficial owners of an aggregate of approximately 17.9 million sharesmore than 10% of the Company’s common stock which sharesto file reports of ownership of the Company’s common stock with the SEC and to furnish the Company with a copy of those reports.

Based on the Company’s review of the reports and upon the written confirmation that the Company received from each of its executive officers and directors, the Company believes that all Section 16(a) reports were timely filed in 2018.

| 17 |

| Proposal No. 2: Advisory Vote to Approve Executive Compensation |

Stockholders are being asked to approve, on an advisory non-binding basis, the compensation of the Named Executive Officers as described in this Proxy Statement.

Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote for the non-binding, advisory stockholder vote on the compensation of the Named Executive Officers, although they will be considered present for the purpose of determining the presence of a quorum.

The Company seeks to closely align the interests of the Named Executive Officers with the interests of the Company’s stockholders. Pay for performance is an essential element of the Company’s compensation philosophy. The Company’s compensation programs are designed to reward the Named Executive Officers for the achievement of short-term and long-term strategic and operational goals, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

The Company currently conducts annual advisory votes on executive compensation. At the Company’s 2018 Annual Meeting of Stockholders, the stockholders expressed continued support of the executive compensation program with 99% of the stockholders casting votes supporting the proposal.

This Proposal No. 2, commonly known as a “say-on-pay” proposal, is not intended to address any specific element of compensation; rather, your vote relates to the overall compensation structure of the Named Executive Officers, as described in this Proxy Statement. The Company asks you to support the following resolution:

“RESOLVED, that the stockholders APPROVE, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables, and narrative discussion.”

| üOur Board recommends that you vote FOR the advisory vote to approve executive compensation. |

| 18 |

In this section, the Company describes its compensation programs and policies and the material elements of compensation for the year ended December 31, 2018, for its Chief Executive Officer, the principal executive officer (“PEO”), and its two most highly compensated executive officersserving as executive officers at the end of 2018, other than the PEO, whose total compensation was in excess of 20%$100,000. The Company refers to all individuals whose executive compensation is disclosed in this proxy statement as its Named Executive Officers (collectively, the “Named Executive Officers”).

The Human Resources Committee engaged Willis Towers Watson (“Willis”) during the fiscal year ended December 31, 2018, to periodically consult regarding executive officer and director compensation.

Most recently in March 2018, the Human Resources Committee conducted an independence review regarding its engagement of Willis and concluded that Willis is independent.

The Company’s compensation consultant provides advice to the Human Resources Committee on an as-request basis as follows:

| • | Reviews the Company’s executive compensation program designs and levels, including the mix of total compensation elements, compared to industry peer groups and broader market practices. | |

| • | Provides information on emerging trends and legislative developments in executive compensation and implications for the Company. | |

| • | Reviews the Company’s executive stock ownership guidelines, compared to industry peer groups and broader market practices. | |

| • | Reviews the Company’s director compensation program compared to industry peer groups and broader market practices. |

The table below includes the total compensation paid to or earned by each of the Named Executive Officers for the fiscal years ended December 31, 2018, and 2017.

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | Option Award | Non-Equity Incentive Plan Compensation ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | |||||||||

| Steven Scheinkman, Chief Executive Officer | 2018 | 650,000 | ― | ― | ― | 646,263 | ― | 238,347 | 1,534,610 | |||||||||

| 2017 | 650,000 | 476,775 | 1,906,090 | ― | 513,744 | ― | 968,977 | 4,515,586 | ||||||||||

| Marec Edgar, President | 2018 | 431,923 | ― | ― | ― | 377,815 | ― | 74,969 | 884,707 | |||||||||

| 2017 | 404,404 | 311,738 | 1,007,504 | ― | 201,546 | ― | 505,213 | 2,430,405 | ||||||||||

| Patrick Anderson, EVP, Finance & Administration | 2018 | 312,000 | ― | ― | ― | 196,862 | (550) | 67,800 | 576,112 | |||||||||

| 2017 | 300,000 | 270,050 | 1,007,504 | ― | 142,268 | 1,049 | 484,864 | 2,205,735 |

| (1) | The amounts in this column for 2017 reflect Restructuring Awards paid to the Named Executive Officers upon the successful completion of the Company’s chapter 11 restructuring in August 2017. |

| (2) | The amounts in this column for 2017 reflect the aggregate grant date fair value of stock-based awards (other than stock options) granted in the year pursuant to the Company’s 2017 MIP, computed in accordance with FASB ASC Topic 718. These amounts are not paid or realized by the officer. Additional information about these values is included in Note 9 to the Company’s audited consolidated financial statements contained in the Annual Report on Form 10-K for the year ended December 31, 2017. |

| (3) | Reflects the cash awards under the Company’s STIP (amounts earned during the applicable fiscal year but paid after the end of that fiscal year). |

| 19 |

| (4) | Reflects the actuarial change in the present value of the Named Executive Officer’s benefits under the Salaried Pension Plan determined using assumptions consistent with those used in the Company’s financial statements. Pension accruals ceased for all Named Executive Officers in 2008, and Named Executive Officers hired after that date are not eligible for coverage under any pension plan. Accordingly, the amounts reported for the Named Executive Officers do not reflect additional accruals but reflect the fact that each of them is one year closer to “normal retirement age” as defined under the terms of the Salaried Pension Plan as well as changes to other actuarial assumptions. For 2018, there was an actuarial decrease in the present value of the benefits under the Salaried Pension Plan for Mr. Anderson in the amount of $550. |

| (5) | The amounts shown are detailed in the supplemental “All Other Compensation Table – Fiscal Year 2018” below. |

All Other Compensation Table – Fiscal Year 2018

The table below provides additional information about the amounts that appear in the “All Other Compensation” column in the Summary Compensation Table above:

| Name | Note Award (1) | 401(k) Plan Company Matching Contributions ($) | Deferred Plan Company Matching Contributions ($) | Housing Reimbursement ($) | Miscellaneous ($)(2) | Total All Other Compensation ($) | |||||||

| Steven Scheinkman | 61,776 | 11,000 | 34,550 | 117,727 | 13,294 | 238,347 | |||||||

| Patrick Anderson | 32,653 | 5,076 | 13,094 | ― | 16,977 | 67,800 | |||||||

| Marec Edgar | 32,653 | 11,000 | 14,339 | ― | 16,977 | 74,969 |

| (1) | The amounts reported in this column reflect the aggregate grant date fair value of Second Lien Notes granted under the 2017 MIP computed in accordance with ASC Topic 718. Additional information about these values is included in Note 9 to the Company’s audited consolidated financial statements contained in the Annual Report on Form 10-K for the year ended December 31, 2018, and the amounts paid in PIK interest pursuant to the terms of the Second Lien Notes during 2018. |

| (2) | Includes the cost, including insurance, fuel and lease payments, of a Company-provided automobile or vehicle stipend, a cellular telephone allowance, and personal excess liability insurance premiums paid by the Company. |

The Company has three elements of total direct compensation: base salary, annual incentives, and long-term incentives, which are described in the following table. The Company also provides the Named Executive Officers with limited perquisites and standard retirement and benefit plans (see the sections below entitled “Retirement Benefits” and “Perquisites and Other Personal Benefits”).

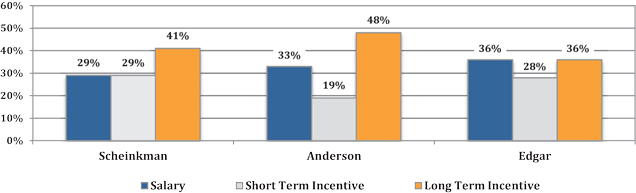

2018 Total Compensation Pay Mix(1)

| (1) | Reflects target annual total direct compensation (e.g., excludes special one-time awards and equity grants such as promotional/hire on grants or the restructuring awards received in 2017). Only tranche A of the 2017 MIP, over its three year life, was included in this analysis. Any awards that may be made in the future from tranche B have not been included. For more information on the MIP see below section titled “2017 Management Incentive Plan”. |

The Company continues to make enhancements to its compensation program to further align leadership performance by focusing on future stock price appreciation to increase value to the Company’s stockholders.

| 20 |

| Pay Element | Description and Purpose | Actions and Recent Enhancements | Link to Business and Talent Retention | |

| Base Salary | ·Fixed compensation recognizes individual performance, seniority, scope of responsibilities, leadership skills, experience, and succession planning considerations. ·Reviewed annually. | ·Mr. Anderson’s salary increased in July 2018 to recognize superior performance and enhanced role and responsibilities. ·Mr. Edgar’s salary increased in connection with his appointment as President of the Company to reflect his enhanced role and responsibilities. | ·Competitive base salaries help attract and retain executive talent. ·Increases are not automatic or guaranteed. | |

| Annual Incentives | ·Variable compensation based on performance against annually established targets and individual performance. ·Designed to reward executives for annual performance on key operational and financial measures, as well as individual performance. | ·Focused programs on branch, function, and whole-Company profitability as well as individual employee performance; for 2018, the Company’s main goals were to focus on continued growth, while ensuring strong EBITDA and inventory performance. | ·Metrics and targets are evaluated each year for alignment with business strategy. ·Consistent with strategy to focus on growth, incentive was based on the executive management team’s individual efforts in generative revenue while simultaneously driving EBITDA and inventory performance. | |

| Long-Term Incentives | ·Variable equity compensation; payable in the form of equity or other securities of the Company. ·Designed to drive sustainable performance that delivers long-term value to stockholders and directly ties the interests of executive to those of stockholders. ·The Human Resources Committee reviews the equity metrics annually. | ·For 2018, the equity as provided is in the Management Incentive Plan, generally a mix of restricted stock and other securities of the Company. | ·The Company’s long-term incentive program is designed to focus on stock price appreciation. |

Base Salary

With the exception of the CEO, whose compensation was reviewed and recommended by the Human Resources Committee and approved by the independent members of the Board, the Human Resources Committee reviewed and approved the base salaries of the Named Executive Officers in 2018. In each case, the Human Resources Committee took into account the CEO’s recommendation, as well as experience, internal equity, the performance of each Named Executive Officer during the year, and external competitive compensation data, among other factors. Fixed compensation recognizes individual performance, seniority, scope of responsibilities, leadership skills, experience, and succession planning considerations.

Annual Incentives

Annual incentives are awarded under the Company’s Short-Term Incentive Program (“STIP”) and are subject to the terms of the A. M. Castle & Co. 2017 Management Incentive Plan (“MIP”). The purpose of the STIP is to provide variable compensation based on Company performance against annually established key operational and financial

| 21 |

measures, as well as individual performance. Metrics and targets under the STIP are evaluated each year for alignment with business strategy.

2018 STIP Payouts

For the 2018 STIP, the Board approved a plan for the Named Executive Officers that focused on three metrics: (1) top-line revenue performance; (2) EBITDA performance; and (3) net working capital improvement performance. However, based on the Company’s overall performance in 2018, the Human Resources Committee and full Board exercised their discretion, in accordance with the STIP plan, to adjust the 2018 STIP payouts downward.

2017 Management Incentive Plan

At the Company’s emergence from restructuring proceedings on August 31, 2017, the MIP became effective. The Human Resources Committee administers the MIP and has broad authority under the MIP, among other things, to: (i) select participants; (ii) determine the terms and conditions, not inconsistent with the MIP, of any award granted under the MIP; (iii) determine the number of shares of the Company’s common stock outstanding prior to such issuancebe covered by each award granted under the MIP; and will have in excess(iv) to determine the fair market value of 20% ofawards granted under the voting power inMIP. Persons eligible to receive awards under the Company before such issuance.

In addition, an affiliateMIP include officers and employees of the Company Raging Capital Management, LLC and certainits subsidiaries. The types of its affiliates (the “Raging Capital Group”), will hold $2.94 million in aggregate principal amountawards that may be granted under the MIP include stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance shares, and other forms of cash or stock based awards.

The Company grants long-term incentive awards under the New Convertible Notes followingMIP to the Exchanges, which could result in the issuance of approximately 1.3 million sharesNamed Executive Officers to reward performance over a multi-year time period. Equity-based compensation remains an important component of the Company’s common stock upon conversion, which is in excess of 1%overall compensation strategy to align the interests of the Named Executive Officers with the interests of its stockholders and serves as an important tool for the Company with respect to attracting and retaining executive talent.

Retirement Benefits

The following retirement plans are generally available to all non-union, salaried employees, including the Named Executive Officers:

| • | Salaried Pension Plan. The Company maintains the Salaried Employees Pension Plan (the “Salaried Pension Plan”), a qualified, noncontributory defined benefit pension plan covering eligible salaried employees who meet certain age and service requirements. As of June 30, 2008, the benefits under the Salaried Pension Plan were frozen. There are no enhanced pension formulas or benefits available to the Named Executive Officers. Of the current Named Executive Officers, only Mr. Anderson is eligible to receive benefits under the Salaried Pension Plan. | |

| • | 401(k) Savings and Retirement Plan. The Company maintains the 401(k) Savings and Retirement Plan (the “401(k) Plan”), a qualified defined contribution plan, for its employees in the United States who work full-time. There are no enhanced 401(k) benefits available to the Named Executive Officers. Refer to the All Other Compensation Table above for the Company’s contributions to each Named Executive Officer under the 401(k) Plan. |

The Company also maintains the following plan that is available to a limited number of sharessenior management employees, including the Named Executive Officers:

Perquisites and Other Personal Benefits

The Company provides the following limited perquisites to the Named Executive Officers: automobile usage or stipends; phone allowances; personal excess liability coverage policy; reimbursement of spousal travel expenses on Company business in certain limited instances; and medical, dental, life insurance, short-term, and long-term

disability coverage (standard benefits available to most of its employees). In 2018, Mr. Scheinkman, who is required to maintain a residence in Chicago as CEO of the Company, was provided a monthly living allowance towards living expenses.

Employment-Related Agreements